Problem Statement: The home buying process involves numerous parties and extensive documentation, making it difficult to fully automate the appraisal process. Extracting information from scanned documents with diverse content and handling the volume of data adds to the complexity.

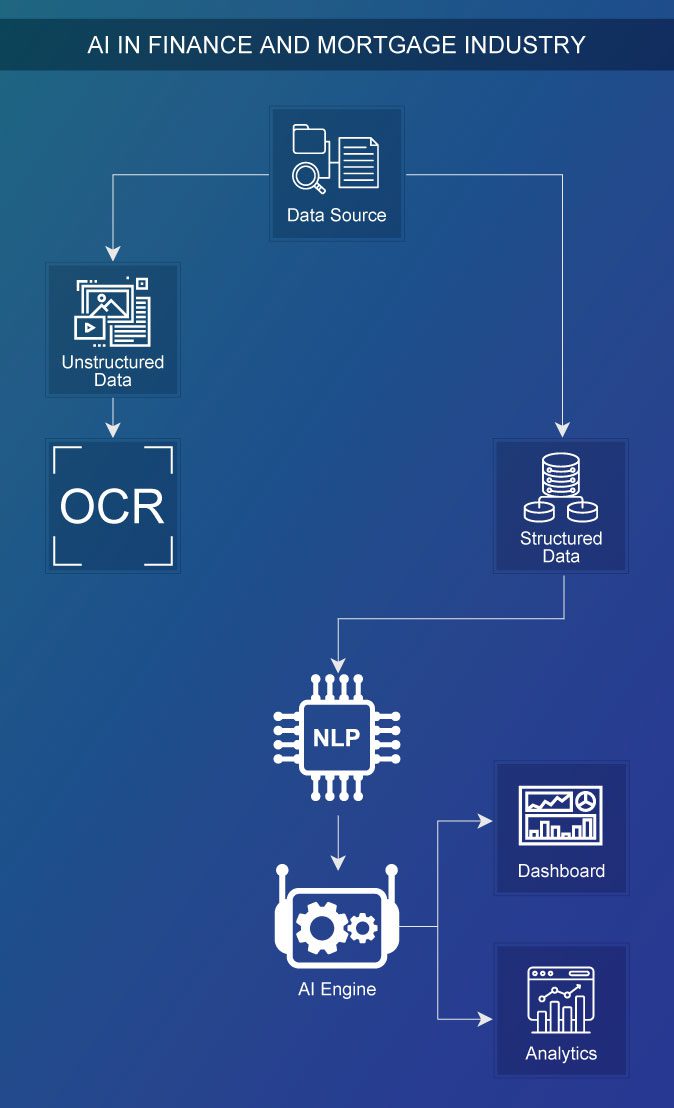

Our AI-Based Solution: We provide the customer with AI-powered solutions that include:

- Information Extraction: Convert scanned documents into standardized MISMO (Mortgage Industry Standards Maintenance Organization) XML format, extracting 1080 distinct data elements from various sources.

- Data Harmonization and Normalization: Utilize AI and NLP algorithms to harmonize and normalize data from different sources for accurate record mapping and analysis.

- AI Risk Score Prediction: Replace 700+ handcrafted rules with a neural network-based AI model to predict risk scores using appraisal data.

- AI Loan Payment Status Prediction: Develop a deep learning model using 4.5 billion loan records to predict home loan payment statuses throughout the loan’s life.

Result: With AI, the company now offers a fully automated solution for banking and mortgage clients, reducing risks and costs.

Machine Learning Models: Camelot & PyPDF2 extract the data from pdf and ANN (Artificial Neural Network), XGB (Extreme Gradient Boosting) classifier for prediction.